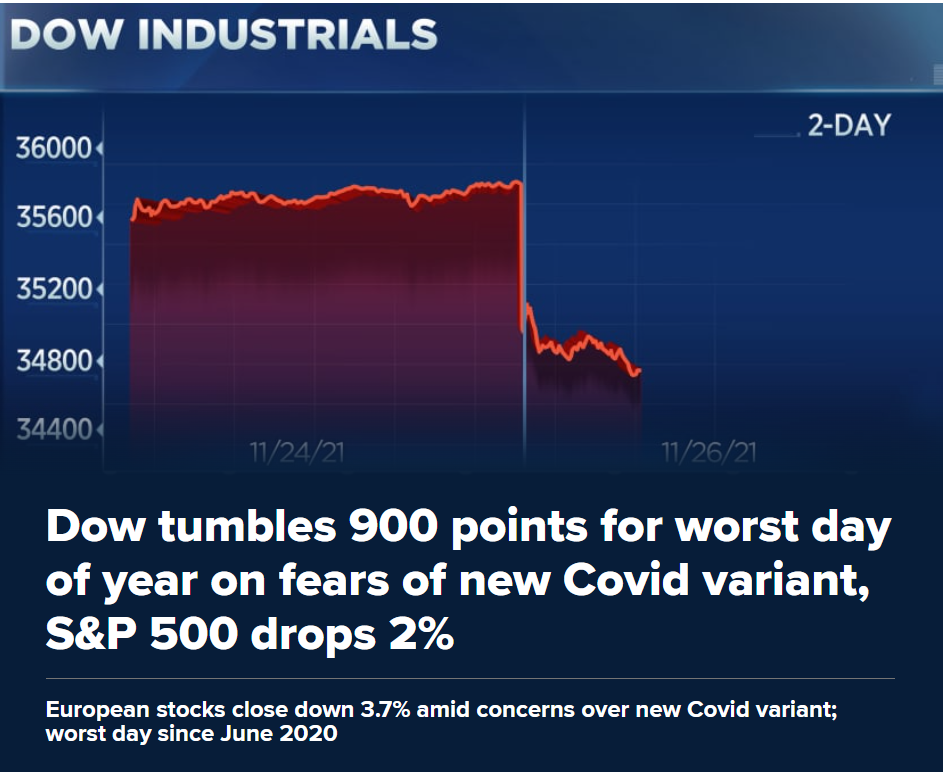

Don’t let CNBC scare you! They are trying to sell eyeballs and will say whatever they can to get you to click on their scary headlines. There are 2 ways I ended the day with some positive trades:

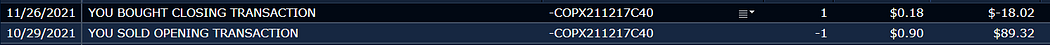

- Covered Calls — I love to sell covered calls in precious metals and miners. I bought 100 shares of SLV and 100 shares of COPX several months ago and have been selling short out of the money monthly covered calls against them. Today SLV and COPX both dropped, making my short calls worth more. I usually sell and roll out to the next month when they are worth 50% less than I sold them for, and today that happened in both.

2. NOB Spread. “Notes over Bonds” is a form of a pairs trade where you want the 10 year rate to decrease and you want to the 30 year rate to increase. It’s a belief that the yield curve is too flat and needs to steepen or mean revert back to more normal times. I did this by selling the 10 year rate and buying the 30 year rate. Today the 10 year rate dropped 8.15% and the 30 year rate only dropped 5.69%. This means that since I entered the trade last week, the spread between the 10 year and 30 year rates increased, which helps move me in the right direction. Technically, on 11/26, I am down $22 in the trade ($184–$162), but I’m moving in the right direction as long as the rate yield curve continue to steepen.

I use TastyWorks to trade the yield curve in this way. If you are interested in learning more about this, consider creating a TastyWorks account and check out our Money Vikings site for more info! Black Friday code for Money Vikings is GOBBLE50