Navigating a Tariff War: Financial Strategies for the Middle Class

Tariff wars can create uncertainty and impact the economy, but it’s important to stay focused on your personal finances. This post outlines five strategies for middle-class individuals to navigate these challenging times.

1. Stay Calm and Carry On

One of the most crucial things you can do is avoid panic. If you have a well-diversified investment portfolio, stick to your strategy. Market volatility is normal, and reacting emotionally can lead to poor decisions. Don’t be tempted to sell off your investments in a downturn; instead, ride out the storm.

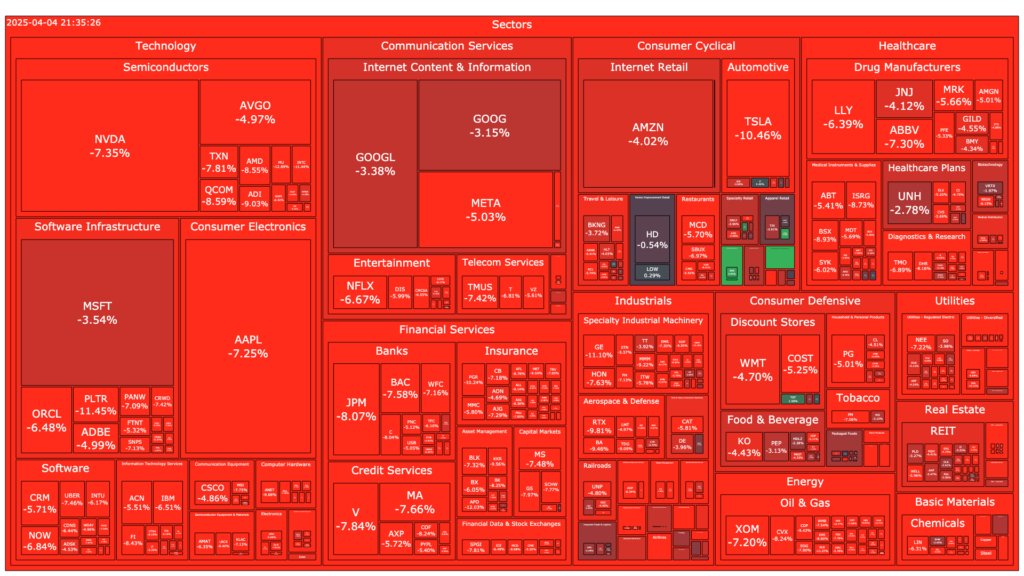

2. Consider Defensive Areas and International

In times of economic uncertainty, certain sectors tend to perform better than others. These “defensive sectors” can offer some stability to your investments. Some examples include:

- Gold: Often seen as a safe haven asset.

- Defense: Government spending on defense tends to remain stable.

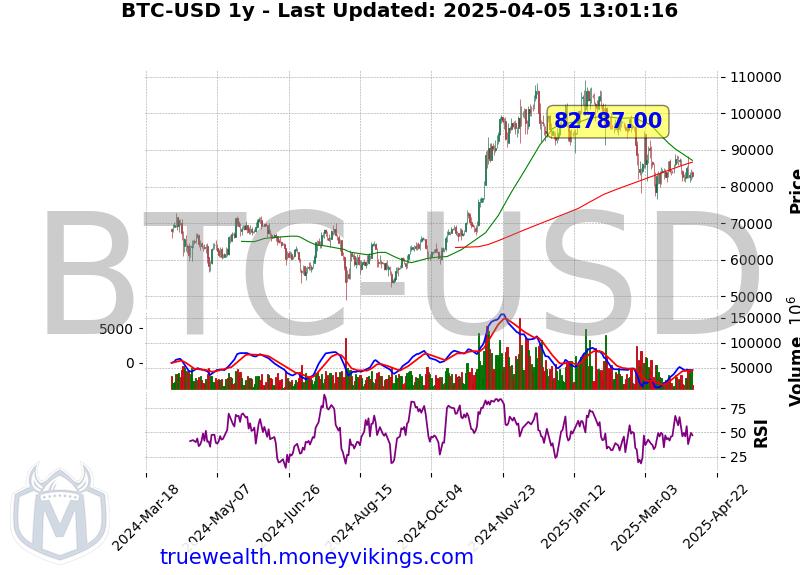

- Bitcoin: Some investors view cryptocurrencies as a hedge against economic instability.

- Consumer Staples: People will always need essential goods like food and household products.

- Healthcare: Healthcare is a necessity, regardless of the economic climate.

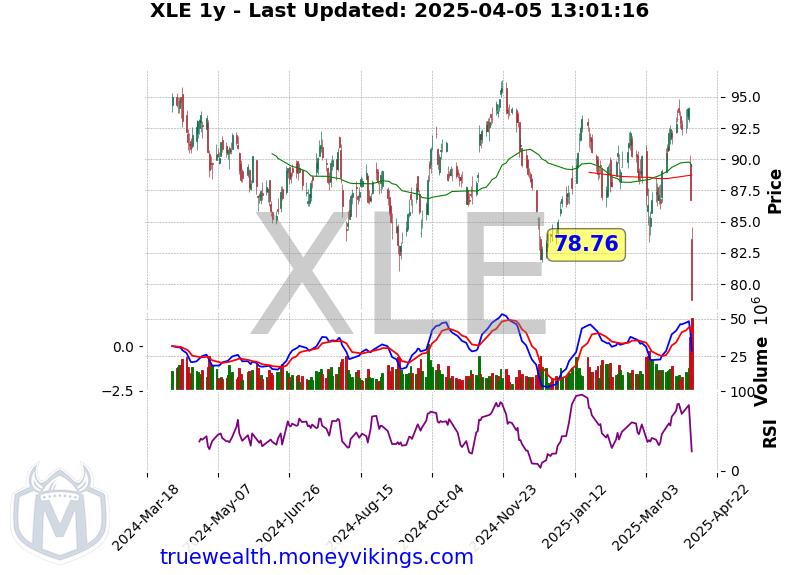

- Energy: Energy is essential for daily life and industry.

Consider diversifying your portfolio to include some of these areas.

3. Defend Against Inflation

Tariff wars can sometimes lead to inflation, which erodes your purchasing power. To protect yourself:

- Buy in Bulk: When possible, buying non-perishable goods in bulk can help you save money in the long run.

- Cut Back on Expenses: Review your budget and identify areas where you can reduce spending.

- Be Mindful of Spending: Track your expenses and make conscious decisions about where your money is going.

4. Avoid Major Purchases

Now might not be the best time to make significant purchases, especially if you have existing debt. Large purchases can strain your finances and increase your financial vulnerability during uncertain times. Delay those big-ticket items if possible.

5. Practice Gratitude

This might seem unrelated to finance, but it’s crucial. Practicing gratitude can help curb overspending. When you appreciate what you already have, you’re less likely to make impulsive purchases driven by anxiety or a desire to compensate for uncertainty.

Final Thoughts

Navigating a tariff war requires a calm, strategic approach to personal finance. By staying calm, considering defensive sectors, defending against inflation, avoiding major purchases, and practicing gratitude, middle-class individuals can weather the storm and maintain their financial well-being.