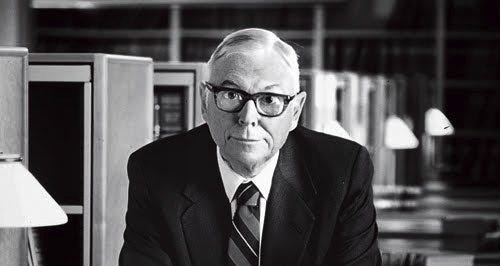

What was it about Charlie Munger? Clearly successful in business and wealth building. A key architect of current day Berkshire-Hathaway. But every time I saw him speak or learned more about him, I felt just a little bit wiser for it. But not just wiser in investing, but wiser about this life as a human. If you look deeper into his famous quotes, he was really talking about the human condition and much more beyond dollars and cents. I really grew to love the guys as a grandfather type figure even though I never knew him personally.

Charlie Munger: Honesty & Candor

I think one of the things I loved about Charlie was his honest candor. He was a person that collected information, thought hard about it and then formed his own view that he would share. This is not always the case in life. Most people just accept the common view of things. Charlie seemed adept at focusing in on something and then finding a straightforward way to address it.

Soldier On

Charlie had more than his fair share of horse shit thrown his way through life, including some major tragedies. He also experienced great opportunities. But either way he seemed to just soldier on and have an ethos of getting up each day and doing the best he could. This is what we can do as people, get up each day and give life our best shot.

Bless your soul Charlie and thank you for all the wisdom.

Charlie Munger, On life:

“I think life is a whole series of opportunity costs. You know, you got to marry the best person who is convenient to find who will have you. Investment is much the same sort of a process.” — 1997 Berkshire Hathaway Annual Meeting

“Another thing, of course, is life will have terrible blows, horrible blows, unfair blows. Doesn’t matter. And some people recover and others don’t. And there I think the attitude of Epictetus is the best. He thought that every mischance in life was an opportunity to behave well. Every mischance in life was an opportunity to learn something and your duty was not to be submerged in self-pity, but to utilize the terrible blow in a constructive fashion. That is a very good idea.” — 2007 USC Law School Commencement Address

“You don’t have a lot of envy, you don’t have a lot of resentment, you don’t overspend your income, you stay cheerful in spite of your troubles, you deal with reliable people and you do what you’re supposed to do. All these simple rules work so well to make your life better.” — 2019 CNBC interview

“With everything boomed up so high and interest rates so low, what’s going to happen is the millennial generation is going to have a hell of a time getting rich compared to our generation. The difference between the rich and the poor in the generation that’s rising is going to be a lot less. So Bernie has won. He did it by accident, but he won.” — 2021 Berkshire Hathaway Annual Meeting

Charlie Munger, On learning

“Without the method of learning, you’re like a one-legged man in an ass-kicking contest. It’s just not going to work very well.” — 2021 Daily Journal Annual Meeting

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads — and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.” — Poor Charlie’s Almanack

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help — particularly when you have a long run ahead of you.” — 2007 USC Law School Commencement Address

“I think that a life properly lived is just learn, learn, learn all the time.” — 2017 Berkshire Hathaway Annual Meeting

“Live within your income and save so that you can invest. Learn what you need to learn.” — Damn Right! : Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger

Charlie Munger, on the stock market

“I think value investors are going to have a harder time now that there’s so many of them competing for a diminished bunch of opportunities. So my advice to value investors is to get used to making less.” — 2023 Berkshire Hathaway Annual Meeting

“There is so much money now in the hands of so many smart people all trying to outsmart one another. It’s a radically different world from the world we started in.” — 2023 Berkshire Hathaway Annual Meeting

“What everybody has learned is that everybody needs some significant participation in the 12 companies that do better than everybody else. You need two or three of them, at least.” — Acquired podcast in 2023

“I wish everything else in America was working as well as Costco does. Think what a blessing that would be for us all.” — 2022 Daily Journal Annual Meeting

“I love everything about Costco. I’m a total addict, and I’m never going to sell a share.” — 2023 Daily Journal Annual Meeting

On meme stocks: “What we’re getting is wretched excess and danger for the country. A lot of people like a drunken brawl, and so far those are the people that are winning, and a lot of people are making money out of our brawl.” 2021 Daily Journal Annual Meeting

Charlie Munger, on Investing

“One of the inane things [that gets] taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks. That is an insane idea. It’s not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather it be my best ideas instead of my worst. And now, some people can’t tell their best ideas from their worst, and in the act of deciding an investment already is good, they get to think it’s better than it is. I think we make fewer mistakes like that than other people. And that is a blessing to us.” — 2023 Berkshire Hathaway Annual Meeting

“I find it much easier to find four or five investments where I have a pretty reasonable chance of being right that they’re way above average. I think it’s much easier to find five than it is to find 100. I think the people who argue for all this diversification — by the way, I call it ‘deworsification’ — which I copied from somebody — and I’m way more comfortable owning two or three stocks which I think I know something about and where I think I have an advantage.” — 2021 Daily Journal Annual Meeting

“If you’re going to invest in stocks for the long term or real estate, of course there are going to be periods when there’s a lot of agony and other periods when there’s a boom. And I think you just have to learn to live through them. As Kipling said, treat those two imposters just the same. You have to deal with daylight and night. Does that bother you very much? No. Sometimes it’s night and sometimes it’s daylight. Sometimes it’s a boom. Sometimes it’s a bust. I believe in doing as well as you can and keep going as long as they let you.” — 2021 Daily Journal Annual Meeting

“Mimicking the herd invites regression to the mean (merely average performance).” — Poor Charlie’s Almanack

“I think that the modern investor, to get ahead, almost has to get in a few stocks that are way above average. They try and have a few Apples and Googles or so on, just to keep up, because they know that a significant percentage of all the gains that come to all the common stockholders combined is going to come from a few of these supercompetitors.” — 2023 Wall Street Journal interview

“There are huge advantages for an individual to get into a position where you make a few great investments and just sit on your ass: You are paying less to brokers. You are listening to less nonsense. And if it works, the governmental tax system gives you an extra 1, 2 or 3 percentage points per annum compounded.” —Worldly Wisdom by Charlie Munger 1995-1998

“I think the reason why we got into such idiocy in investment management is best illustrated by a story that I tell about the guy who sold fishing tackle. I asked him, ‘My God, they’re purple and green. Do fish really take these lures?’ And he said, ‘Mister, I don’t sell to fish.'” — “A Lesson on Elementary, Worldly Wisdom As It Relates To Investment Management & Business,” 1994 speech at USC Business School

“The world is full of foolish gamblers and they will not do as well as the patient investors.” — 2018 Weekly in Stocks interview

“It takes character to sit with all that cash and to do nothing. I didn’t get to be where I am by going after mediocre opportunities.” — Poor Charlie’s Almanack

“Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things.” — Poor Charlie’s Almanack

Charlie Munger, on new technologies

“The electric vehicle is coming big time, and that’s a very interesting development. At the moment, it’s imposing huge capital costs and huge risks, and I don’t like huge capital costs and huge risks.” — 2023 Berkshire Hathaway Annual Meeting

“I am personally skeptical of some of the hype that has gone into artificial intelligence. I think old-fashioned intelligence works pretty well.” — 2023 Berkshire Hathaway Annual Meeting

On Big Tech regulation: “I would not break them up. They’ve got their little niches. Microsoft maybe has a nice niche, but it doesn’t own the Earth. I like these high-tech companies. I think capitalism should expect to get a few big winners by accident.” — 2023 “Acquired” podcast

“We now have computer algorithms trading with other computers. And people buying stocks who know nothing, being advised by people who know even less. It’s an incredibly crazy situation … All this activity makes it easier for us.” — 2022 Berkshire Hathaway Annual Shareholders Meeting

Here are a few of his thoughts, many lifted from a very recent podcast:

• The world is full of foolish gamblers, and they will not do as well as the patient investor.

• If you don’t see the world the way it is, it’s like judging something through a distorted lens.

• All I want to know is where I’m going to die, so I’ll never go there. And a related thought: Early on, write your desired obituary — and then behave accordingly.

• If you don’t care whether you are rational or not, you won’t work on it. Then you will stay irrational and get lousy results.

• Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.

• You can learn a lot from dead people. Read of the deceased you admire and detest.

• Don’t bail away in a sinking boat if you can swim to one that is seaworthy.

• A great company keeps working after you are not; a mediocre company won’t do that.

• Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.

• Ben Graham said, ‘Day to day, the stock market is a voting machine; in the long term it’s a weighing machine.’ If you keep making something more valuable, then some wise person is going to notice it and start buying.

• There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.

• You don’t, however, need to own a lot of things in order to get rich.

• You have to keep learning if you want to become a great investor. When the world changes, you must change.

• Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.

• Finally, I will add two short sentences by Charlie that have been his decision-clinchers for decades: ‘Warren, think more about it. You’re smart and I’m right.’