The Death of the 60/40 Portfolio Is Greatly Exaggerated

Weekly Market Report

SPY, had a volatile but decent week, up over 4%. On the daily, it closed above the 20 EMA (blue line — 369.78). Could the 20 EMA become the new support? With options expiration this past Friday most expected to see a down move, however we had a nice surprise to the upside. Also notable is that on the weekly (not pictured) we closed about the 200 SMA, indicating a possible support. I’m not getting bullish or bearish, just trying to stay small and nimble, taking appropriate risks for the size of my portfolio. I may actually start dollar cost averaging into TLT or using options to play for a bounce soon.

This week I asked a question (21:47) on Engineering the Trade about a covered call in SLB and got some great expert advice and a deep dive into how to use the TastyWorks platform to track an options Intrinsic Value.

SPY

Bitcoin – Stuck in the Middle With You

Basically unchanged this week, still stuck in the 19,000 range, trading just below 20 day EMA. I did notice on the bollinger bands that we seem to be narrowing, indicating perhaps a sharp move up or down in the not too distant future.

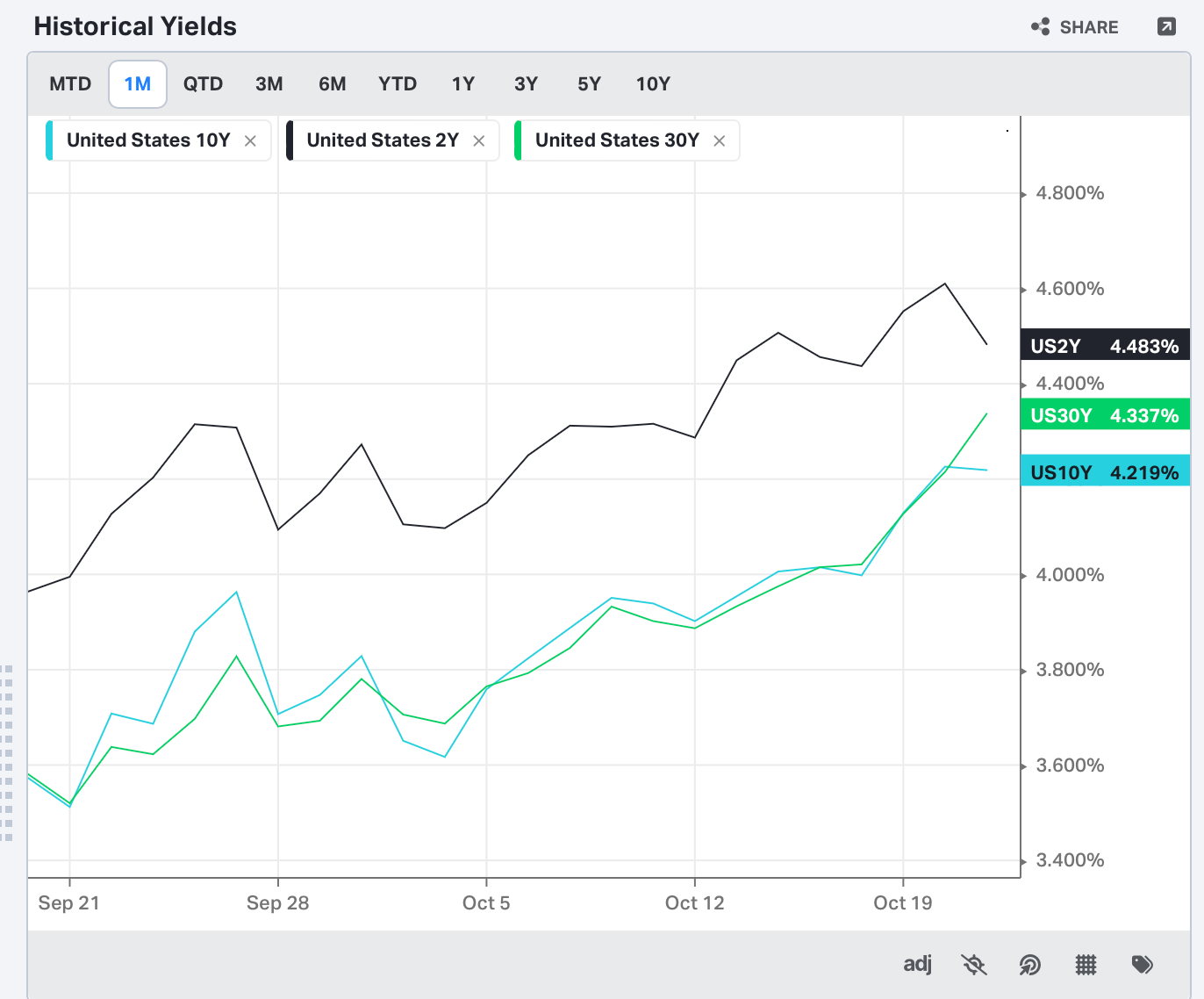

Rates, Yields, and Bonds

With all 3 benchmark rates over 4% and rising for the week, we are monitoring the 30 year which was up this week over 32 basis points. The 2 year is leading at 4.483% but perhaps losing steam as the inverted curve seems to be flattening.

The VIX

Closing below 30, the VIX lost 6.93% this week indicating less fear in the market.