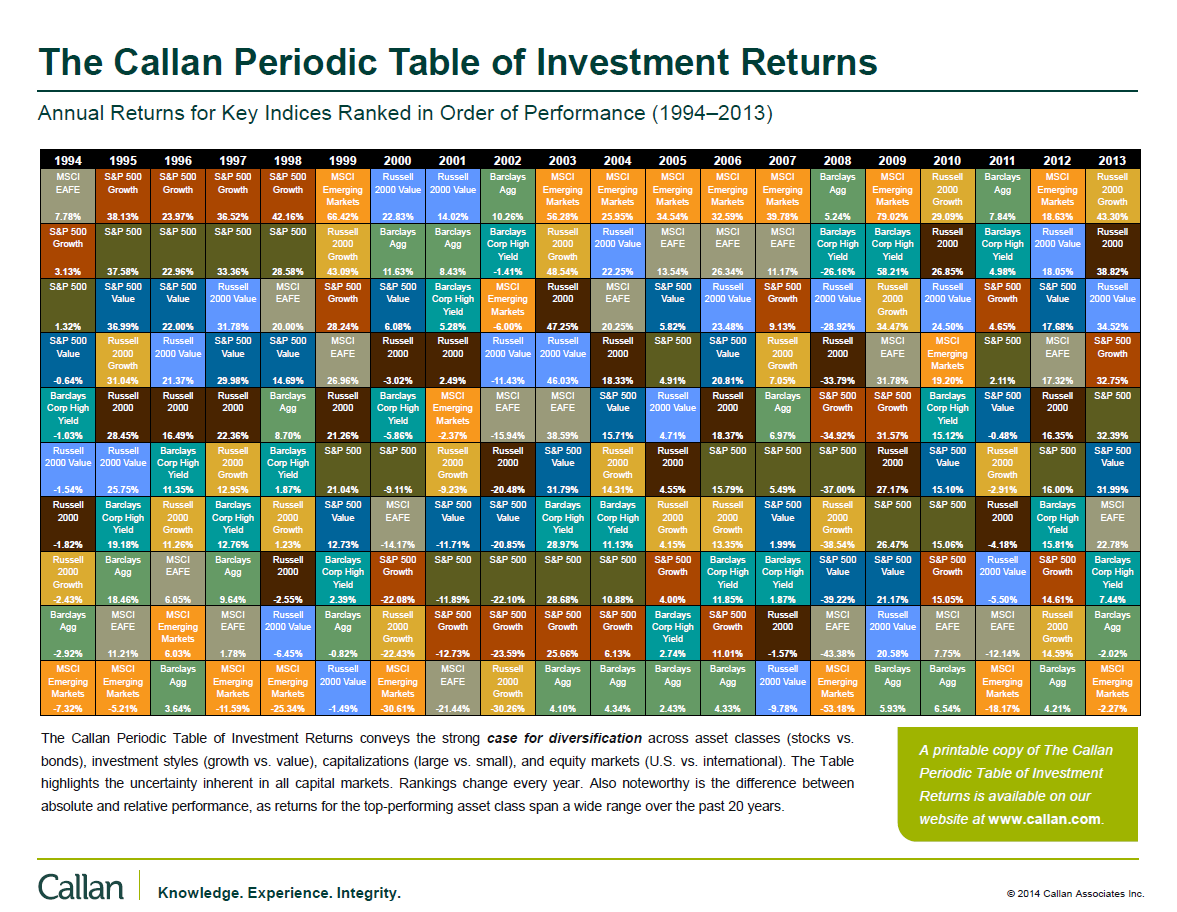

With the market volatility and stock market, bond market, and global markets in flux, you might think that Greg and I are worried. We are not! Why? Are we selling all our stock to catch all the gains we can before they are lost? No. We diversify our investments. We go into these markets fully understanding that when we enter we are taking a risk, and we are only risking a percentage of our portfolios that we are comfortable with. Chasing fashionable asset classes is a fool’s errand. Illustrating this principle below is a Callan Periodic Table. It shows you over the past 19 years that the rankings of each asset class tend to change over time. For example, during the prior recession, Emerging Markets were profitable. Currently they are not. In a year or two they could be again. Value and Growth Stocks tend to change change. Some argue the market will be shifting from Growth (think AMZN & GOOG) to Value (i.e. Macy’s, JC Penny) Small Caps and Large Caps change as well. This chart is a living document that fundamentally shows us the value of proper diversification. It also shows us that past winners do not guarantee future winners.